-

A Track Record of

Innovation and Leadership -

Our Business

We help individuals and corporates by providing innovative credit solutions to meet their financial goals and growth aspirations. Our credit business (formerly known as "financing business") that are largely uncorrelated to markets, that is highly complementary to our investment and funds management businesses. They also give us market leading asset origination and servicing platforms, as we develop alternative investment products in the lending industry.

Consumer Finance

The Group’s consumer finance business is conducted via UAF, who primarily offers unsecured loans to individuals and small businesses in Hong Kong and Mainland China through a well-established branch network and sophisticated online platforms. It is a market leader in personal loans in Hong Kong and Mainland China and holds several off-line money lending licences in major cities in China, as well as internet money lending licences which allow it to conduct its online loan business across the country. In recent years, UAF has been a pioneer in modern loan offerings such as, through its advanced mobile App “Yes UA”, customers can have online authentication of smart Hong Kong identity card. The “One-Click-to-Loan” service allows customers to complete their loan application and approval processes anytime, anywhere. Upon approval, customers can drawdown loans via the “Faster Payment System” (FPS) interbank clearing solutions launched by Hong Kong Monetary Authority.

Find out more at United Asia Finance.

Mortgage Loans

Building upon the Group's credibility, financial strength and professional experiences, SHK Credit provides 1st mortgage & 2nd mortgage loan to property owners and potential property owners, as well as customised financing solutions to property investors in Hong Kong. Established in 2015, SHK Credit has a significant market presence in providing mortgage loans in Hong Kong.

In 2024, SHK Credit launched the Mortgage Serving Business to manage institutional-owned residential mortgage portfolio.Find out more at Sun Hung Kai Credit.

Investment Management

In 2015, the Company established the Investment Management division (formerly known as “Principal Investments”) and began its evolution into a leader in alternative investing. Investment Management leverages the Group’s expertise, network, and financial strength to seek attractive risk-adjusted investment opportunities across global markets and sectors.

PUBLIC MARKETS

This includes the Company’s internally managed strategies, corporate holdings and cash. We actively manage all sub-portfolios and carefully use derivatives and hedging to increase returns and manage risk.

ALTERNATIVES

Hedge Funds and Private Equity

The Company’s investments in externally managed private equity funds and hedge funds, as well as private equity direct and co-investments. The portfolio seeks to maximise risk-adjusted returns and diversify exposure by industry and geography, while giving the Company a global view of the alternative investment landscape.

Special Situations and Structured Credit

The Special Situations and Structured Credit strategy focuses on leveraging unique opportunities emerging from market dislocations or specific events. Our portfolio predominantly includes investments in distressed or mispriced assets and has further expanded our footprint in Western Europe, North America and Asia, adding geographical diversification to the Group. Additionally, the residual term loan portfolio from Private Credit has been integrated into this segment. Our approach to targeting distressed or complex opportunities is designed to yield favourable returns with robust defensive characteristics.

Real Estate

The Real Estate portfolio includes the Group’s interests in Hong Kong commercial real estate as well as hotels and commercial investments in global markets. It is a core strength of the Group and we expect to continue grow our portfolio going forward.

Funds Management

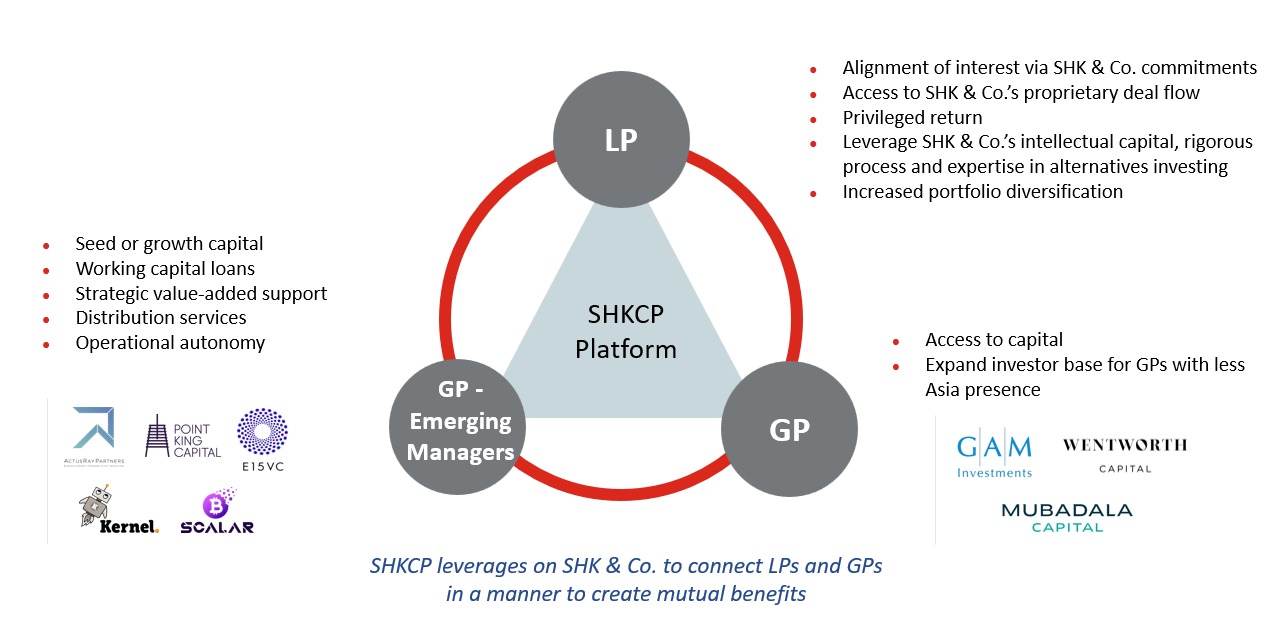

Founded in 2020, SHKCP is the Hong Kong SFC regulated subsidiary of SHK & Co., with Type 1, 4 and 9 licenses.

SHKCP leverages the Group’s strong background in alternative investments and capital markets to launch and grow funds with teams who have a unique approach in investing. SHKCP also provides customised advisory services to ultra-high-net-worth clients through its Family Office Solutions platform.

Our focus is to generate long-term value and returns to meet our clients’ needs. We offer differentiated access to a wide range of alternative investment strategies and Family Office Solutions through:

- Funds managed by SHKCP

- Funds managed by our Partners through a proven partnership model

- Providing customised solutions and access to unique investment opportunities

Funds Management Business Model

SHKCP is continually seeking strong teams and existing firms with specialized investment strategies for partnership opportunities. If you think your team is ready to make that leap, we would be interested to hear your story and approach. Please Contact Us.

Find out more at Sun Hung Kai Capital Partners.